Assets & Investments

Investment Portfolio Information

Raukawa ki te Tonga AHC Limited (AHC) was established as the commercial organisation to manage the various settlement assets and investments of Raukawa ki te Tonga Trust (the Trust) in a commercial and sustainable basis.

As at 30 September 2020, the financial year-end, the AHC Investment Portfolio totalled $26,658,938.00 (excluding cash) based on fair market value where applicable.

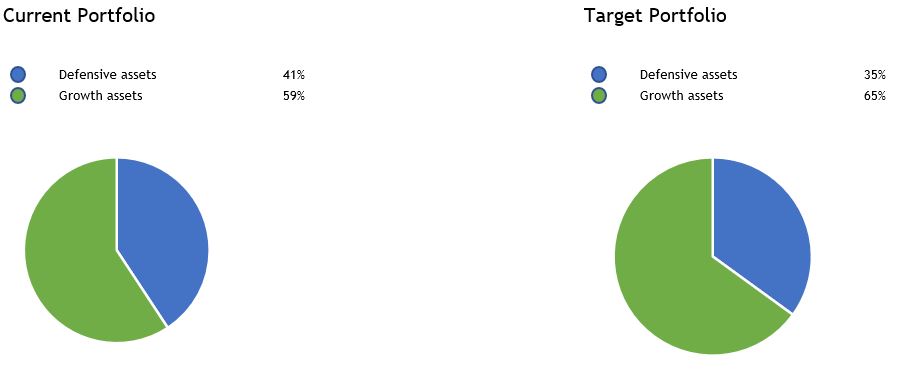

The Raukawa ki te Tonga AHC Limited Board has continued its diversified investment strategy with the target portfolio of 65 per cent allocation to growth assets and 35 per cent allocation to defensive assets. The objective of diversification is to develop an investment portfolio of various asset classes which have limited correlation therefore react differently to market conditions.

As a result, the overall return on the portfolio should be less volatile over time. Whilst the portfolio remains over-weight to fisheries assets, this is mainly due to the restrictions on settlement assets.

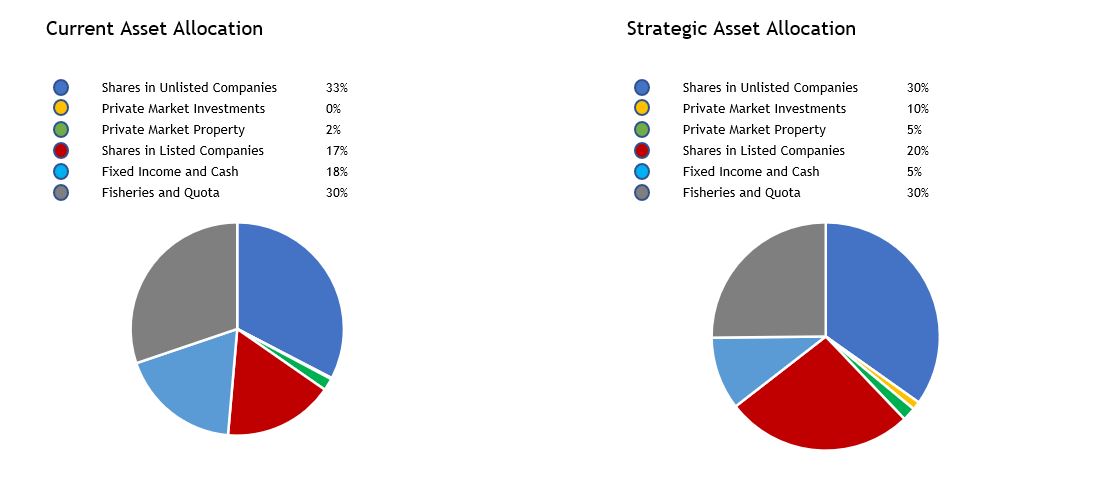

The following pie-charts below show the Current Asset Allocation of the Asset Holding Company's investment portfolio as at 30 September 2021, see left-hand chart, compared with the Strategic Asset Allocation (the target portfolio), based on fair market value where applicable.

It is accepted that the Current Asset Allocation is never going to perfectly align to the Strategic Asset Allocation as investment values change over time and due to the time it takes to reallocate capital, especially private market investments which are not easily traded. However, when opportunities arise, the AHC will look to increase market exposure to Private Market Investments and Private Market Property and reduce exposure to Fixed Income and Cash.

As shown in the pie-charts below, the portfolio is currently over-weight in defensive assets, based on values at 30 September 2020.

Given the extremely volatile economic conditions over the 12 months ending 30 September 2020, the relatively stable performance of the investment portfolio has proved that the diversified strategy implemented has been robust. However, the Board remains cautious about the years ahead given the economic headwinds that exist, especially for the New Zealand fisheries industry.

Investment Governance

The board has undertaken a review of the Company’s financial assets to better manage investment risk in an increasingly uncertain and volatile environment. Conscious of the need to sustain and grow the dividend to the Trust that fund its charitable and cultural programmes for the benefit of Ngāti Raukawa, we have adopted an Investment Governance Policy (IGP) so that investment decisions are consistent with best practice. The IGP provides a detailed framework to guide the governance of private market investments, the diversified portfolio of listed securities, and other investment activity the Raukawa ki te Tonga AHC Limited undertakes

To be consistent with best practice and to achieve our targeted returns, we have outsourced the management of the company's investment portfolio to investment specialists. While the Raukawa ki te Tonga AHC Limited board retains the governance responsibility for the company's investments, we have outsourced investment research, due diligence and portfolio design to MyFiduciary. My Fiduciary are independent and experienced investment consultants who provide independent investment research required for asset allocation, fund selection and advisory services that ensure our investments are best placed to provide strong and sustainable returns now and into the future.

Fisheries Assets – Background

In 2010 Ngāti Raukawa ki te Tonga received the agreed settlement quota resulting from the Maori Fisheries Act 2004. At this time, the Raukawa ki te Tonga Charitable Trust was established as the mandated Iwi Organisation (MIO), the governance entity for the iwi for fisheries settlement purposes.

In 2010 Ngāti Raukawa ki te Tonga received the agreed settlement quota resulting from the Maori Fisheries Act 2004. At this time, the Raukawa ki te Tonga Charitable Trust was established as the mandated Iwi Organisation (MIO), the governance entity for the iwi for fisheries settlement purposes.

The Asset Holding Company (AHC) was also established to receive and hold fisheries settlement assets including quota and income shares in Aotearoa Fisheries Limited. Since that time, the AHC has purchased additional non-settlement quota, with a current market value of over $5.0 million.

As at 30 September 2020, the AHC's fisheries assets represent approximately 62 per cent of the total portfolio based on Fisheries Quota valued at $8,525,644 and ALF Shares valued at cost of $8,959,631.